Integrated Ecosystem

Custom-built for financial services

Building your own foundation model is difficult, expensive, and time-consuming.

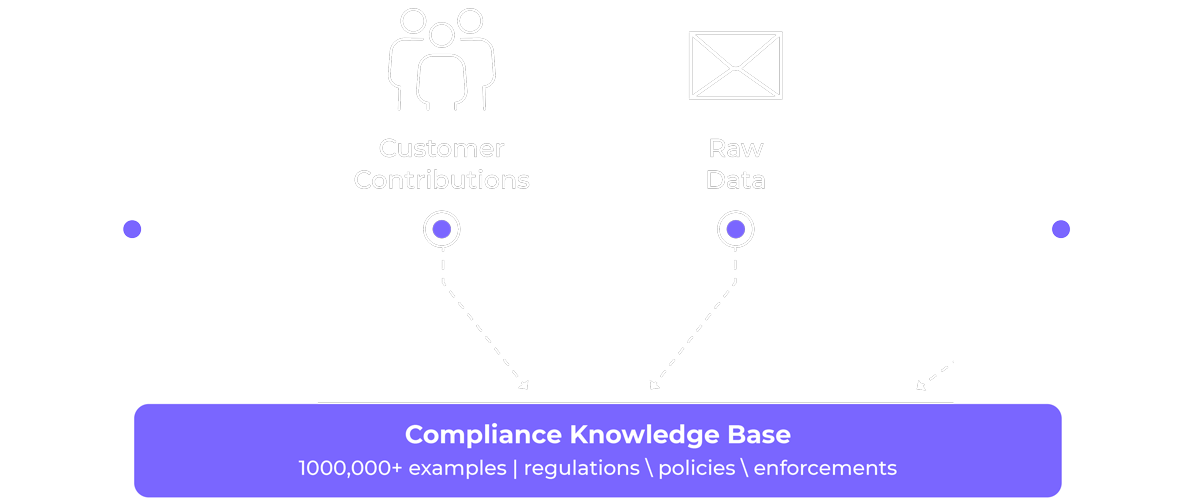

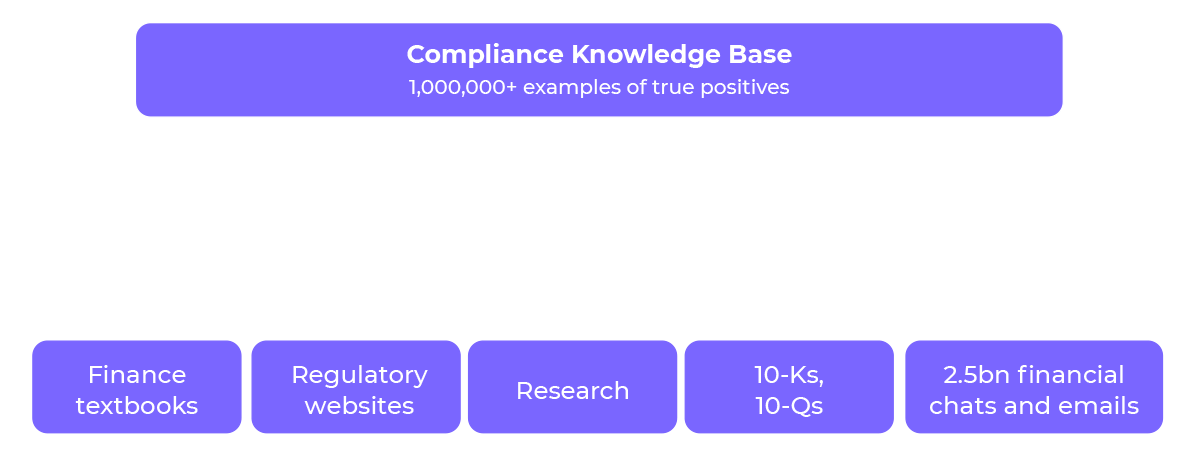

Unlike generic LLMs like GPT-4 or Gemini, Behavox LLM 2.0 is uniquely trained on proprietary data donated by our customers, as well as data collected from over 50 regulatory sources and agencies. This data is specific to the domains and subject matter of our customers, enabling the foundation model to deeply understand the language, context, and nuances of their businesses.

As a result, our specialized model continues to outperform generalist models in domain-specific tasks such as compliance and regulatory understanding in financial services.

Behavox LLM is an expert in compliance

Control and understanding

Institutions in financial services are required to have control over mission-critical systems. This means not only controlling version change of models, but also having a deep understanding of how these models are built and being able to inspect the training datasets if needed.

Behavox LLM 2.0 was created by Behavox, and the training dataset, training process, and infrastructure can be inspected by customers if needed. Updates and additional content trained into the model may be thoroughly tested and validated by customers prior to incorporating new content into their environment. The customer may choose to adopt or not.

Affordable and effective

Affordability is a key criteria for any company deploying an AI-based solution.

Our Behavox Quantum platform optimizes communications surveillance by processing terabytes worth of communications data per day and generating alerts on potential market abuse cases or financial crime. If the platform relied on a third party model with pay-per-token commercials, it would cost users hundreds of thousands of dollars per day to process their communications data.

Financial services institutions want high-quality alerts, but without breaking the budget. Behavox Quantum uses the proprietary Behavox LLM 2.0 to scan terabytes worth of data affordably. For one of our global, systemically important banking customers we process data and generate alerts in 15 languages across voice and text – and the total cost is just under USD 10 per day.

“BNY Mellon continues to find opportunities to tap into powerful and innovative technologies offered by firms like Behavox.”

Tom Wileman, Managing Director

Head of Global Compliance

Minimizing hallucinations

A hallmark feature of Behavox LLM 2.0 is its ability to minimize hallucinations.

General-purpose models often fail to capture the nuances of specialized fields, leading to inaccurate outputs. Behavox LLM 2.0, by contrast, has been pre-trained on a vast array of finance-specific data in over 50 languages, including regulatory filings, enforcement cases, and proprietary communications data.

This ensures high levels of accuracy when interpreting regulations, summarizing financial jargon, and performing complex financial calculations.

Trusted and deployed at scale

Behavox LLM 2.0 is robust, proven, and deployed at scale across all continents by institutions including banks, asset managers, hedge funds, private equity firms, and crypto firms.

Powering our interconnected ecosystem, it enables these institutions to benefit from savings and revenue growth by deploying AI at enterprise scale, without incurring the risk of building their own technology or relying on generalist models.