Product highlights

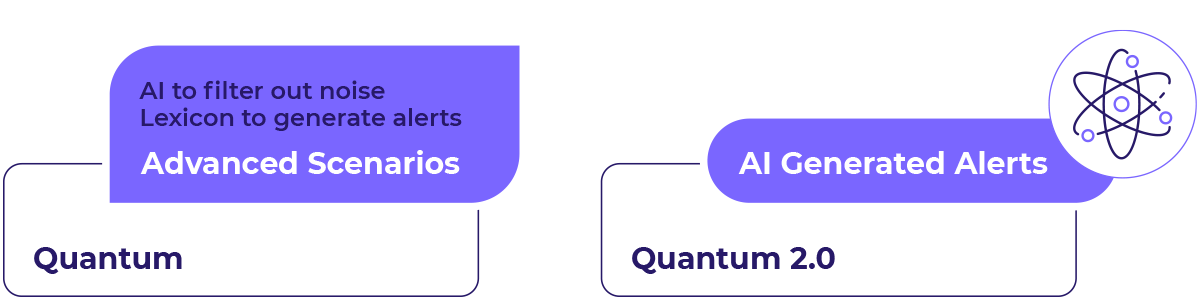

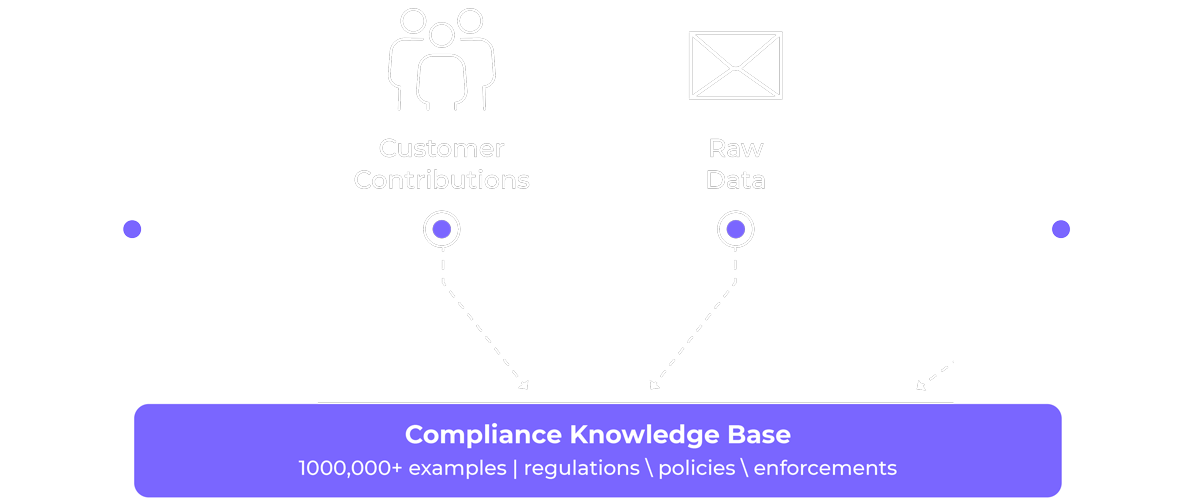

Intuitive platform leveraging advanced AI

Leverages AI which is easy to use and an expert in identifying risks.

Affordable and powerful compliance solution

Powerful and affordable risk management solution.

“Since migrating to Quantum, we are seeing a significant reduction in false positives and an uptick in interesting alerts.”

Compliance Officer

Global Financial Institution

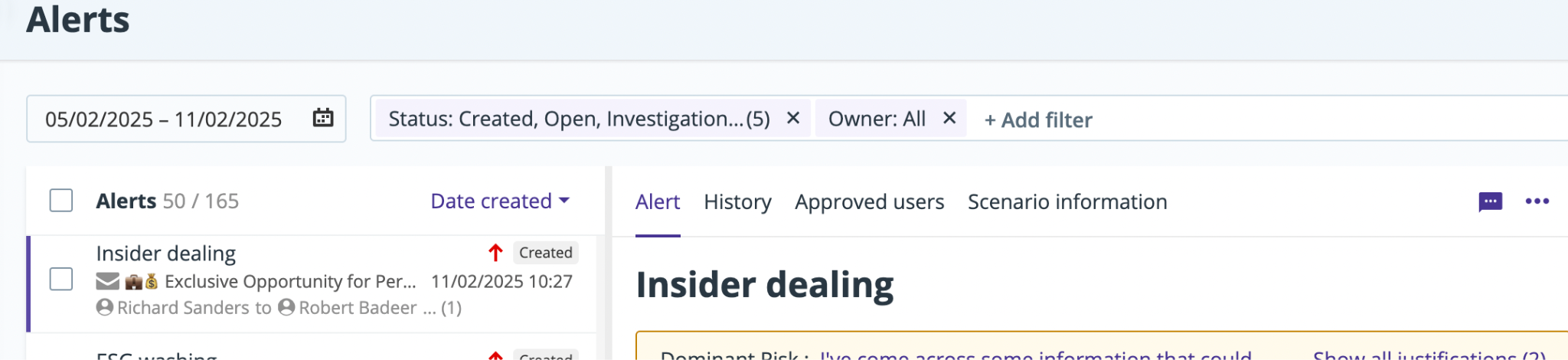

Alerts

Generates meaningful and manageable high quality actionable alerts.

Features

Efficient alert management

Review, investigate, and act on AI-generated alerts collaboratively, with a configurable workflow.

Scenario testing lab

Test, refine, and optimize scenario configurations to enhance risk detection accuracy and performance.

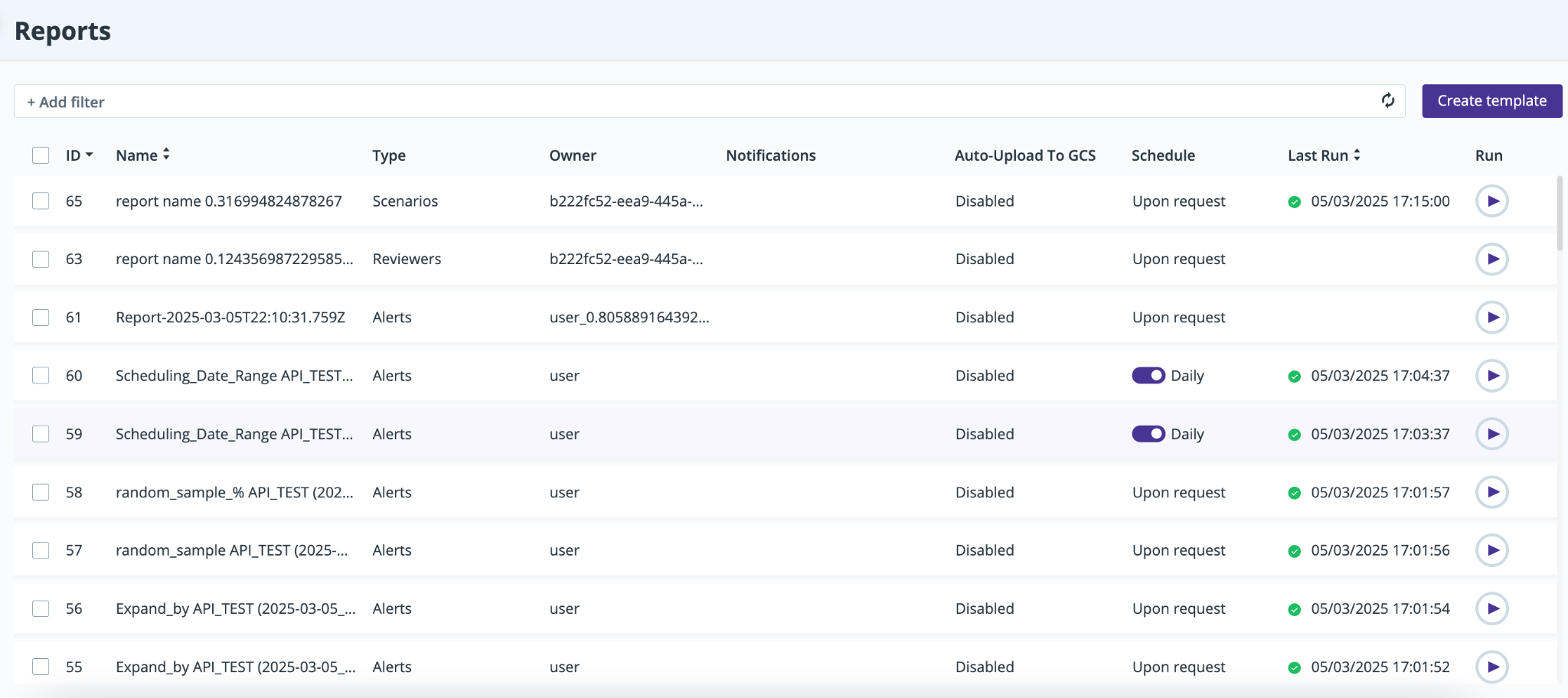

Comprehensive and flexible reporting

Customizable reports, ensuring transparency, regulatory adherence, and data-driven risk management.

Robust data management

Detailed reports on data ingestion, processing, and content analysis.

Advanced search capabilities

Intuitive search across text and voice communications with focus on speed and accuracy.

Retention policies

Personalized retention policies for each data type, ensuring data management aligns with your specific needs and compliance requirements.

Flexible workflows

Configure different workflows for alert review, including second level QA review process.

Flexible deployment

Delivered as an end-to-end solution that integrates with over 150 different communication channels.

“If you think that people are unfiltered on email, there is absolutely no filter when it comes to phone calls.”

Chief Compliance Officer

Leading Global Hedge Fund

Features

Review alerts

Investigate transcripts and metadata, ensuring accurate compliance monitoring.

Unified view

View voice calls alongside synchronized transcripts in a single interface.

Advanced voice search

Conduct in-depth investigations across voice communications and transcripts.

Download and analyze

Export voice recordings and transcripts for further analysis, audits, and regulatory reporting.

Seamless call playback

Access and listen to voice calls directly within the platform.

Falcon

Transform your insider threat management with Behavox Falcon

Unleash the power of advanced AI and behavioral analytics to proactively detect, investigate and prevent insider threats using communications data.

“The depth of insights that communications can provide into potential motives and human risk is astounding. Behavox has truly set a new benchmark in this domain.”

Head of Insider Risk

Tier 1 Investment Bank

Product Highlights

Proactive insider threat detection

Advanced AI helps uncover motive and identify vulnerable individuals within your organization, enabling proactive intervention and risk mitigation..

Detect malicious activity in communications

Integrate with 150+ communication data types to detect a wider coverage of insider threats, including flight risk, data exfiltration, sharing of credentials, classifications of sensitive documents, unauthorized interactions with media, and more.

Explainable and intuitive AI solution

Easy to use and leverages advanced AI that is transparent and explainable.

Higher risk detection and coverage

Generate high quality true positive insights across different insider risks categories, maximizing your operational efficiency and resources.

Multilingual coverage

Monitor and analyze insider risks across multiple languages including English, Spanish, French, Danish, German, Chinese, Japanese, Italian, Swedish and many more, ensuring compliance on a global scale.

Other Product Highlights

Customized reporting

Build your own customizable reports, ensuring flexibility, transparency and data-driven risk management.

Flexible configuration workflows

Flexible configuration support for efficient supervision and monitoring workflows.

Exporting Insights

Export functionality to help export and ingest Falcon alerts data into other corporate security tools.

“Behavox’s unique insights on disgruntlement and flight risk compelled us to foster collaboration across departments, breaking down silos and enabling early intervention for risk mitigation.”

CISO

Global Asset Management Firm

Intuitive alert management

Built-in alert management capabilities generate and review the detected risks.

Comprehensive data security

Built for privacy and SOC2 Type 2 compliant, Behavox is trusted by large, regulated and publicly listed institutions. Behavox Falcon has built-in privacy features such as masking and ACLs to protect the identity of employees.

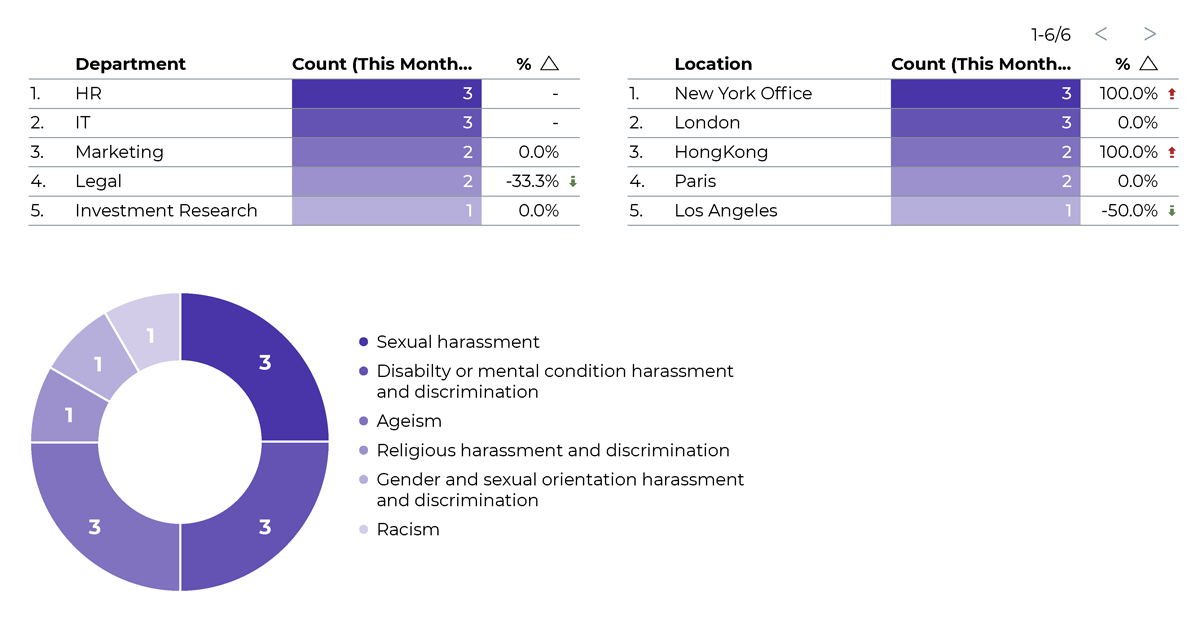

Conduct

Maximize conduct and culture compliance with AI-powered misconduct detection

Product Highlights

Advanced AI-driven misconduct detection

Behavox AI-powered Conduct and Culture solution has in-built risk detection and alert management capabilities that identifies and preempts workplace misconduct, and prevents financial and reputational damage.

Multilingual Coverage

Behavox Conduct processes text and voice communications in multiple languages, ensuring seamless global compliance monitoring.

Comprehensive risk coverage

Behavox’s risk taxonomy built by legal and compliance experts, caters to different industry verticals and covers a wide range of misconduct risks such as legal risks (e.g. harassment, discrimination), cultural risks, employee disgruntlement insights, and health and safety risks.

Seamless integration across data sources

Monitor conversations across 150+ data types in a single, unified interface for comprehensive misconduct detection.

Other Product Highlights

Intuitive platform for alerts review

Investigate flagged communications for misconduct with context-rich insights and metadata.

Export for audit & reporting

Easily extract customizable reports with Conduct alerts data for regulatory compliance and internal reporting.

Flexible workflows

Configure different workflows for alert review, including second level QA review process.

Advanced search & investigation

Behavox Conduct enables deep-dive investigation by searching alerts and relevant communications from all data sources against an individual in one place.

“Behavox’s comprehensive risk coverage shields us from regulators assertiveness on non-financial misconduct, allowing us to focus on business.”

Head of Legal and Compliance

International Bank